Curb Unnecessary Tax Breaks

It’s the largest corporate welfare giveaway in the history of Oklahoma. It’s going to crowd out our ability to do other levels of tax reform, other levels of lower taxes for people, small businesses and other industries that aren’t in oil and gas.

-Senate Finance Committee Chairman Mike Mazzei (R-Tulsa)

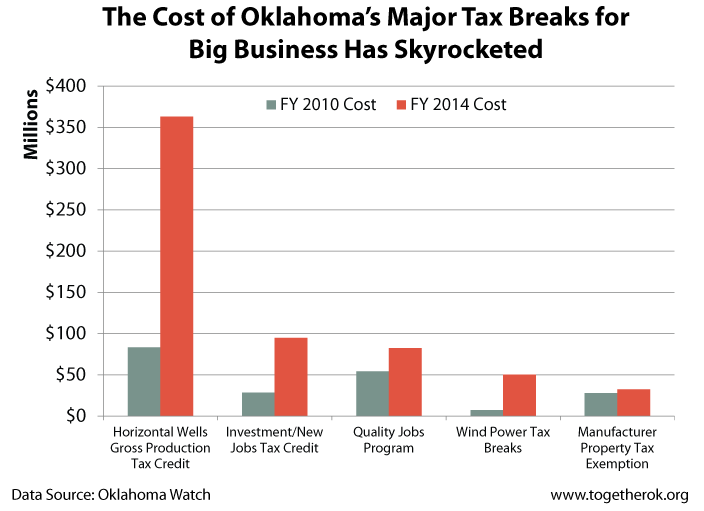

Oklahoma tax breaks to big business have more than doubled since 2010.

- Oklahoma’s major tax breaks for big business have grown from $356 million in 2010 to $760 million in 2014. The cost of these tax breaks has more than doubled at the same time as Oklahoma has slashed funds for education, public safety, and other important services.

- Other loopholes such as the “double deduction” of state income taxes and the lack of combined corporate reporting are costing hundreds of millions in revenue without having any clear economic purpose.

“The simple truth is that a few of these tax credits are like the huckster who took a bucket of manure, covered the top with an inch of honey and sold the whole thing as a full bucket of honey. It wasn’t until the sucker got home with it that he found out what he had actually bought.”

-Representative David Dank (R-Oklahoma City)

These tax giveaways don’t improve the economy when they come at the cost of core services paid for by state taxes. If we value our children, safety, infrastructure, health, and economy, we need to stop hollowing out core state services with wasteful tax subsidies.

What you can do:

- Contact Your Legislators and tell them to prioritize education funding over tax cuts and tax breaks

- Engage Your Community

- Join Our Grassroots Movement

More resources:

- Fact Sheet: Curb Unnecessary Tax Breaks (Together Oklahoma)

- Fact Sheet: Options for a balanced approach to solve Oklahoma’s budget gap (Oklahoma Policy Institute)

- This nonsensical ‘double dipping’ tax break is costing Oklahoma millions (Oklahoma Policy Institute)

- Lawmakers pushing another unproven tax break with no idea what it will cost (Oklahoma Policy Institute)

- Tax and budget bills to watch (Oklahoma Policy Institute)